Debt Repayment Calculator (UK) - Compare Methods & Get Your Plan

Run your UK numbers and compare Snowball, Avalanche, Hybrid or Custom side-by-side. Instantly see your debt-free date, timeline, and estimated interest for each method. DebtRiot is private by default (no sign-up, runs in your browser) and built for UK realities like APR vs EAR, overdrafts and 0% promo cards. Start with the free comparison, then generate a clear month-by-month printable plan when you’re ready.

Try the free comparison, then turn the winner into a plan you can follow.

Built for the UK — including APR vs EAR, overdrafts, 0% promos and realistic minimum payments. Everything runs privately in your browser, with no account and no data storage. When you’re ready, you can turn your chosen method into a personalised month-by-month printable plan with calendars and milestones.

UK-specific logic (APR/EAR, overdrafts, 0% promos, realistic minimums)

Private & anonymous (no account, nothing stored)

Printable month-by-month plan (calendars, milestones, instant download)

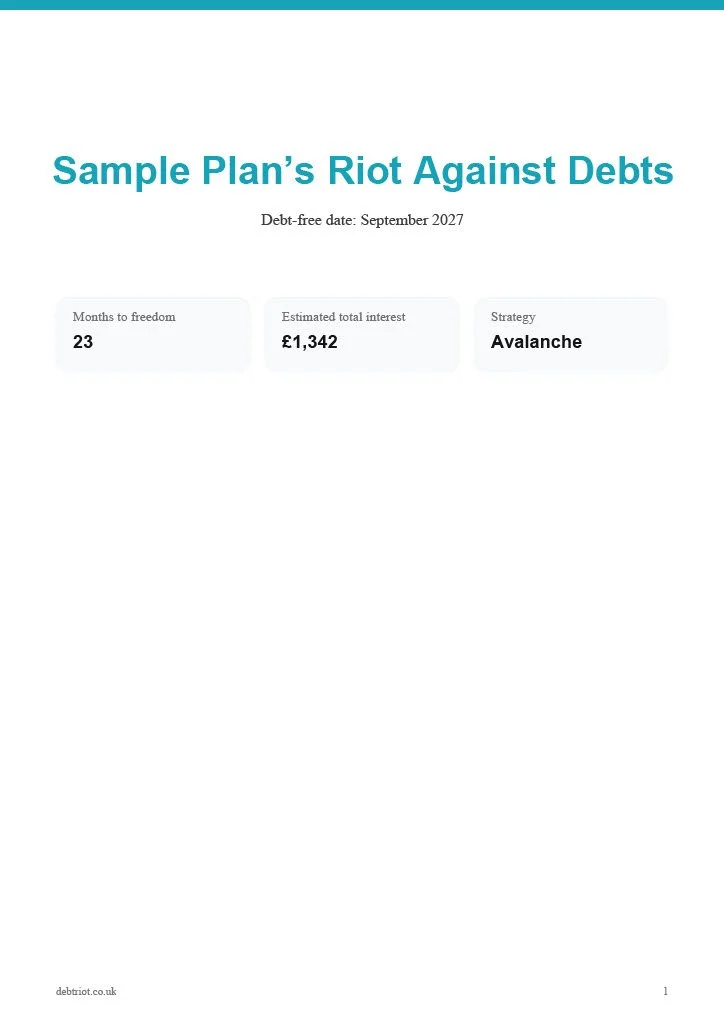

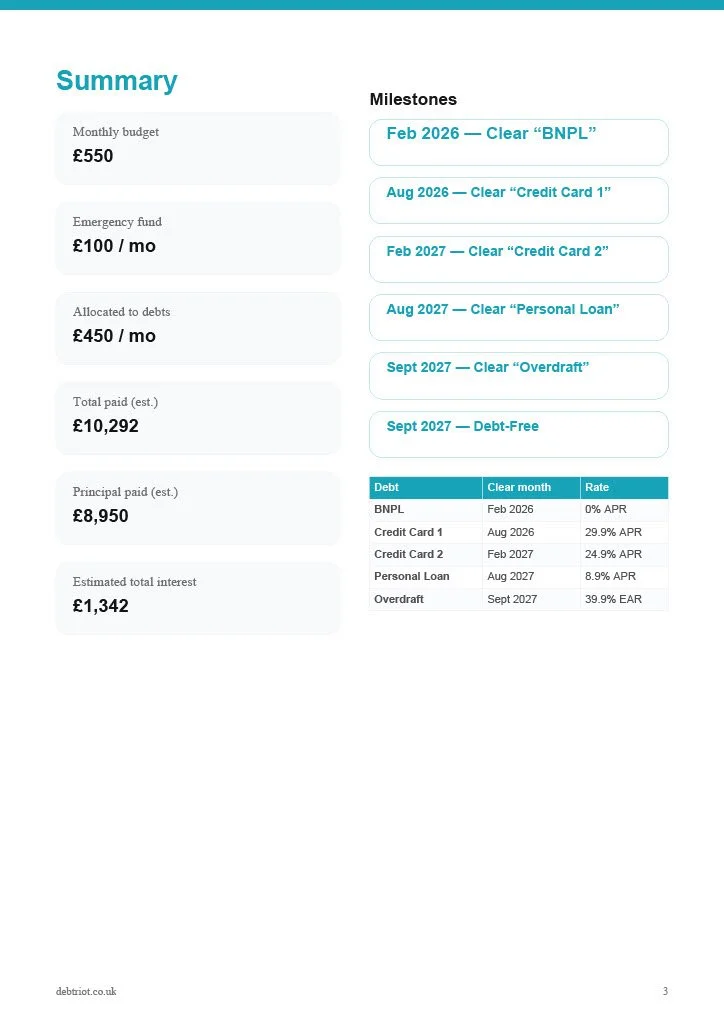

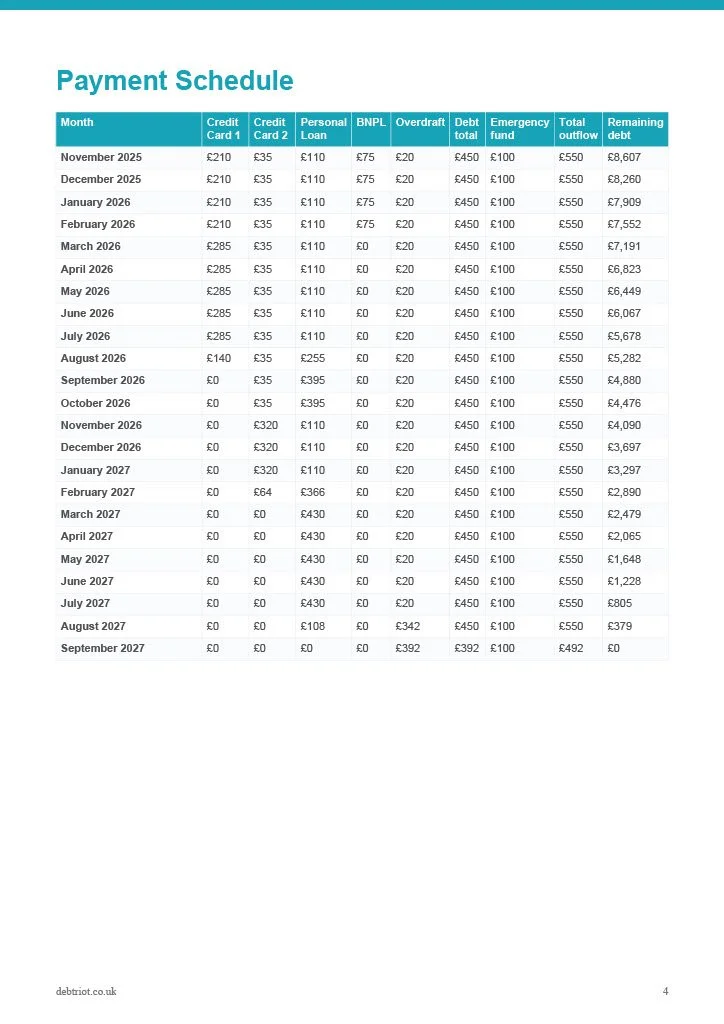

See a real example (what you’ll download)

Here’s what your PDF looks like - clean, printable, and easy to follow.

Summary: budget, emergency fund, allocated-to-debts

Milestones: when each debt clears + debt-free date

Payment schedule: exact monthly payments and printable calendars

How the Calculator Works

(3 Simple Steps)

It takes a minute to preview, and a few more to build your full plan.

Step 1 — Add Income, Costs & Debts

Enter your income, essentials and all debts (cards, loans, overdraft, student loan). Calculations run in your browser — no account required.

Takes about 30 seconds.DebtRiot helps UK users create a personalised debt payoff plan using Snowball, Avalanche, Hybrid (switch after N) or Custom. Your PDF shows your debt-free date, payoff order, monthly payments, printable calendars, and optional What-If savings. If you add a monthly extra, we show exact time and interest saved.

Why Choose DebtRiot

DebtRiot is a single-purpose UK debt payoff planner built for people who want a clear, realistic plan without sharing personal data. It handles UK specifics like APR vs EAR, overdrafts and 0% promo periods, then turns the best strategy for your numbers into a simple month-by-month schedule you can print or keep on your phone. No accounts, no tracking of your debts - just a plan you can follow.

Built for the UK — credit cards, loans, overdrafts, 0% promos, realistic minimums (APR/EAR included).

Private by default — runs in your browser, no account, no debt data stored.

Actionable printable plan — monthly schedule, payoff order, milestones and calendars.

All strategies included — Snowball, Avalanche, Hybrid and Custom side-by-side.

One-time fee — optional personalised PDF plan (no subscription).

-

No. DebtRiot is a self-guided planning tool. If you’re struggling to meet essentials or repayments, contact free, regulated help like StepChange or National Debtline.

-

No. It runs fully in your browser and does not save your data.

-

Credit cards, overdrafts, personal loans and BNPL. Add 0% promo months and minimum payments where relevant.

-

Snowball clears the smallest balances first (motivation). Avalanche attacks the highest APR/EAR first (minimises interest). You can also use Hybrid or Custom.

-

Yes. Set promo months for a debt; we treat the APR as 0% for that period, then revert.

-

It’s an estimate based on your inputs and standard repayment rules; real-world fees/interest can vary.

-

A downloadable PDF with your monthly schedule, calendars, payoff order, milestones and summary.

Important Information

⚠️ DebtRiot is a self-guided planning tool - not financial advice. It works best if you have steady income and some money left after essentials. If you’re unable to meet your monthly obligations, contact free, regulated help: StepChange or National Debtline

Ready to stop guessing?

Compare methods with your numbers in 60 seconds — then download a plan you can stick to.

Let’s Talk Money.

Got a question or idea?

Use the contact form or email hello@debtriot.co.uk - we usually reply within 24–48 hours (UK business days).

Got questions? See our FAQ